Providing Leadership for a World of Innovation.

At Pappas Capital, we are dedicated to furthering life science discoveries and bringing groundbreaking solutions to market.

04.19.2024

Singapore, 18 April 2024— Horizon Quantum Computing, a company building software ...

Read More

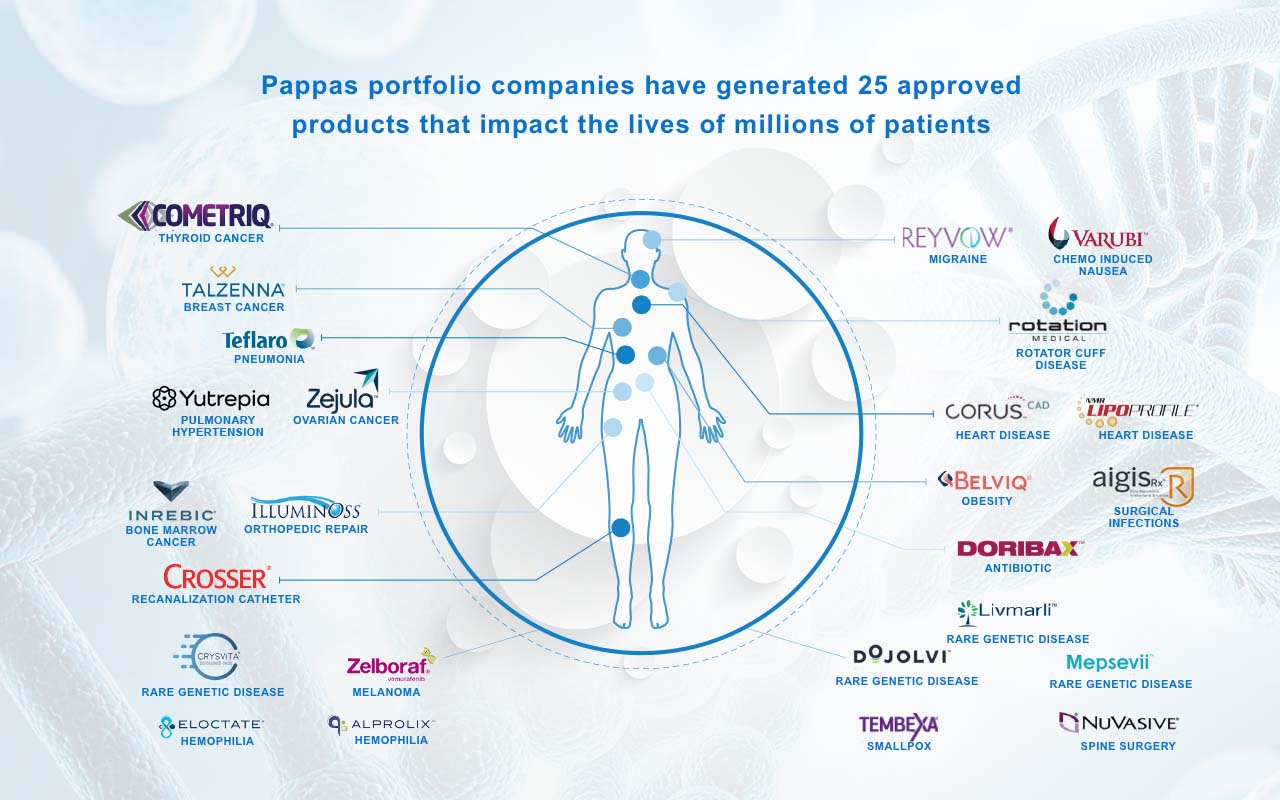

For 30 years Pappas Capital has been investing in and building innovative companies that are developing the next generation of life science products and technologies. We’ve invested in more than 90 companies across the United States, Canada and Asia – in fields that span the range of human disease. The products our companies have brought to market – for treating such conditions as melanoma, ovarian cancer, and hemophilia, to name a few – have been used throughout the world to treat tens of thousands of patients and account for billions of dollars of revenue.

Whether you’re looking for capital or have capital to invest, contact us and learn how we can put our expertise to work for you.